Expertise

Our team of experts brings years of experience and deep knowledge to deliver exceptional results.

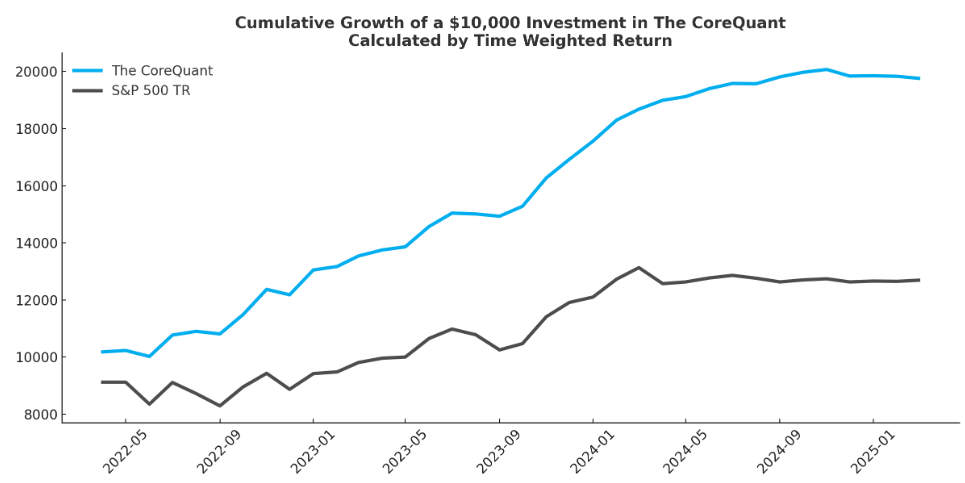

Data driven

We embrace data to stay ahead of the curve and ensure decision making without biases

Client-Centric

Your success is our priority. We tailor our services to meet your unique needs and goals.

Our Products

View allToday's top Insights

Latest breaking news, pictures, videos, and special reports

Daily Market Updates

Stock Market Update: Equities Rise...

Jul 28, 2025

Stock Market Update: S&P 500 Closes...

Jul 23, 2025

Stock Market Update: S&P 500 Tops 6...

Jul 22, 2025

.jpg)

Stock Market Update: CPI Steady, Nv...

Jul 15, 2025